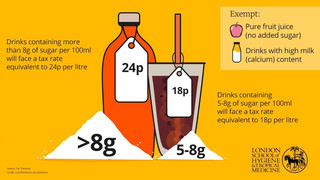

Sugar Tax: is it working?

Evidence shows that a tax on sugary drinks that rises prices by 20% can lead to a reduction in consumption of around 20%, thus preventing obesity and diabetes. One outcome is that the beverage industry is taken out sugar and come up with new drinks for children. Norway, which trebled from 5kg per person per year in 1960 to 15kg in 2008, had fallen to just over 12kg last year, while sales of sugary soft drinks were down from 93 litres per person in the late 1990s to 47 litres. One reason is the introduction of sugar and snack tax, but they also banned advertising on these drinks and snacks, as well they had a good education program.